There is strong evidence that TV is still incredibly relevant as part of an overall advertising media mix.

This post is from our partners at Palisades Media. If TV advertising was dead, they’d know it.

While the industry continues to discuss the demise of traditional” TV as we know it, has anyone bothered to share this information with the top streaming video services looking to gain awareness and viewers?

If so, based on recently reported spending within the “dying” medium, the streaming services are not listening. The biggest streaming platforms – Amazon Prime, Apple TV, Disney+, HBO, Hulu, and Sling TV, collectively spent half a billion dollars on “traditional” TV and Cable platforms in the past three years. The most recent 12-month period represents the highest TV and Cable spend to date at $252MM, a 137% increase over the previous 12-month period.

Streaming advertisers continue to join in on National TV activity, even with the pandemic. Those who added National TV activity to their mix for the first time during the first half of 2020 include AT&T TV, Quibi, Peacock, and HBO Max, who collectively spent about $90MM during their first advertising foray into the medium at the beginning of this year according to a recent VAB report.

This might resonate for anyone who watched the Emmy Awards on Linear TV in September and recall seeing any number of streaming advertisers in the Primetime show, including Peacock, Apple+, HBO Max, Showtime, Hulu, Disney+, and Amazon Prime - just to name a few.

And it is not just the streaming services who are in on the game. According to Moffett Nathanson Research, big brand technology companies like Amazon, Alphabet, Apple, Microsoft, eBay, and Facebook spent an estimated 20% of their media budgets on television in 2019.

So, what is the secret? Why dump so much money, effort, and messaging into a decaying dinosaur of a medium that nobody watches? Could it be, perhaps, that there is a large audience still watching? Sure enough, the numbers prove that most Americans are still spending the majority of their free time watching TV the old-fashioned way. While industry reports tend to focus on the increased growth of streaming video viewing, which is correct, the reports tend to offer little in context on the size of the growing streaming audience versus the size of the shrinking TV audience.

According to Nielsen, as of Q2 2020, streaming comprised one-fourth of all television minutes viewed. True? Yes. Impressive, maybe? However, the flip side gives some additional context: Live+Time Shifted TV still comprises 75% of all television minutes viewed. That’s nearly 4 hours and 30 minutes per day for the average A18+, compared to 1 hour and 6 minutes of streaming.

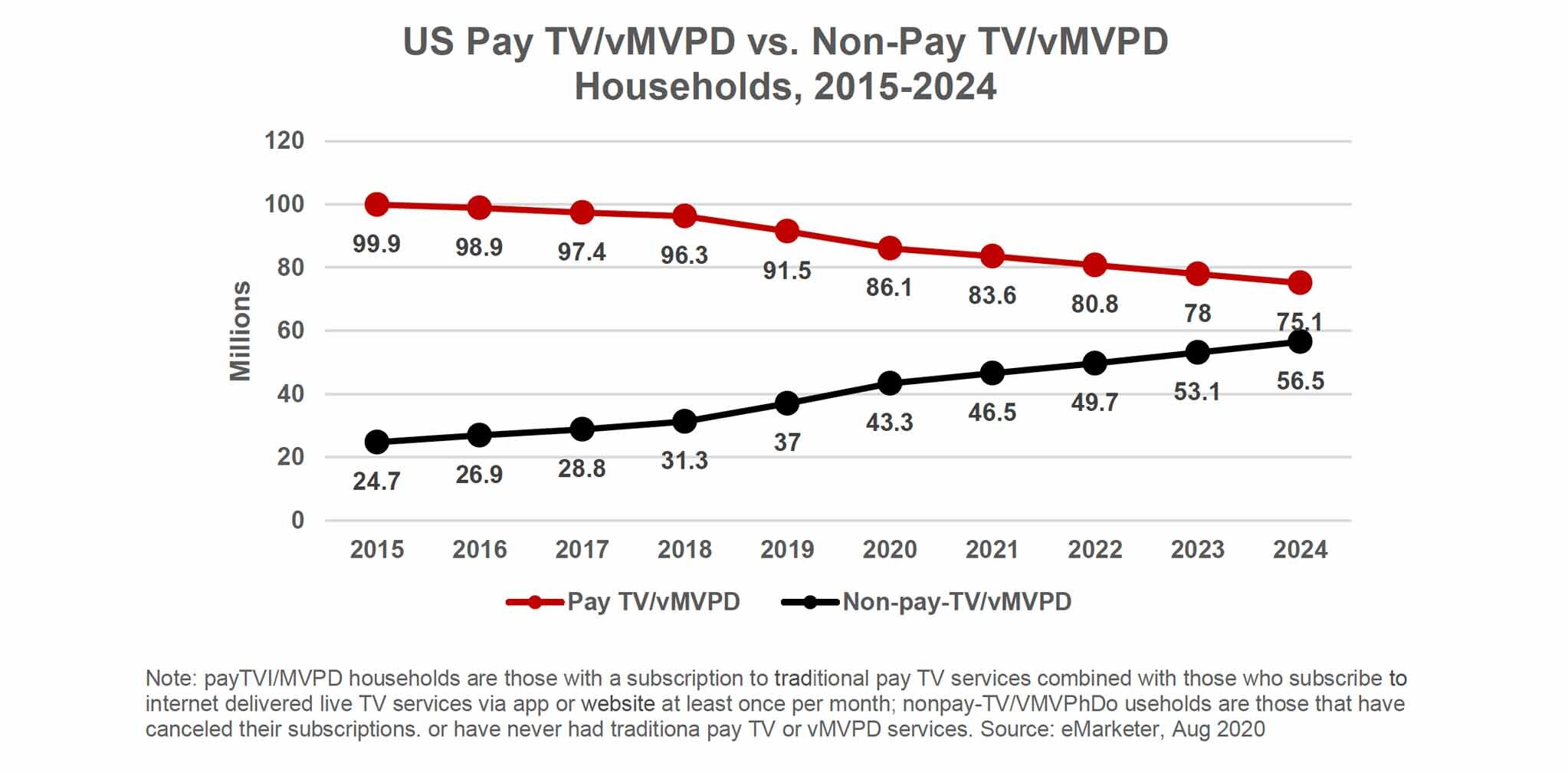

As eMarketer recently reported, this year 86.1 million US households will have Pay TV/vMVPD, a 5.9% year-over-year decrease. Even with this decrease Pay TV/vMVPD households remain double that of Non-Pay TV/vMVPD households. And, looking ahead to 2024, it is projected that Pay TV/vMVPD will still be in 33% more households than Non-Pay TV/vMVPD.

And audience size matters. According to Nielsen, as of Q1 2020 Live + Time-Shifted TV reaches 85% of A18+ on a weekly basis, compared with 49% reach for an Internet-Connected Device. TV remains the dominant video platform to maximize reach.

The emerging content platforms that the industry claims are going to be the death of traditional television continue to build and promote their brands and programming the good old-fashioned way. If TV helped build awareness for Disney+, who is estimated to hit 72.4 million US monthly viewers in 2020, just think what it can do for your brand message. So, don’t listen to the naysayers. TV is NOT dead by any stretch of the imagination.

This guest post from our friends at Palisades Media Group. Thanks, Genevieve Wiersema, SVP, Group Director of Strategy, for sharing your POV with Division of Labor Blog readers.

###

The Small Agency Blog is produced by Division of Labor; a top San Francisco creative agency and digital marketing firm that’s been named Small Agency of the Year twice by Ad Age. The award-winning creative agency services clients on a retainer or project basis. They also offer freelance services and fixed-rate projects for startups and smaller brands.